tax air freight rules tariff

Federal taxes the GST is levied by the Canadian federal government and is typically paid at the time of importation. Effective July 1 2021 the European Commission has updated some of the rules for VAT e-commerce launching an import one stop shop IOSS for online retailers to declare and pay duties and getting rid of the low-value consignment relief policy that previously exempted packages valued at under 22 from VAT.

Ddp Air Cargo To Us Uk Europe Germany France And Amazon Warehouse With Logistics Service With China Freight Forwarder China Freight Forwarder Shipping Agent Made In China Com

Air Freight International Express.

. Taxes on the entry of goods into a local area for consumption use or sale therein The tax is to be paid by the trader to the civic bodies and the rules and regulations of these vary amongst different States in India. Like the US Canada has addition taxes and fees. Value Added Tax Act 1994 - Section 161.

Using our example of footballs and the current list of US HTS Codes there would be a big difference between reporting your pallet of footballs as 95066240 Inflatable balls footballs and soccer balls which can be imported duty free and reporting it as 95066280 Inflatable balls other for which you would pay a 48 import tax. Similar to state taxes PST is a tax issued by the individual Canadian provinces. When your goods are valued at 800 or more and shipped by international express it will be convenient for you to pay the import tax because the express agent will pay it for you in.

In all other cases from the list in UK Trade Tariff. The existing provision of sub-section 3 of Section 40A of the Act provides that any expenditure in respect of which payment or aggregate of payments made to a person in a day otherwise than by an account payee cheque drawn on a bank or account payee bank draft exceeds twenty thousand rupees shall not be allowed as a deduction except in specified. Import Duty MPF Informal Entry 2500.

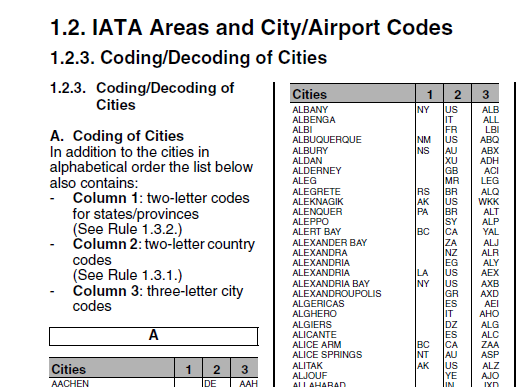

How to Pay the Import Tax. Rules for determining the origin of products eligible for preferential tariff concession for trade between India and Singapore - Notification No. Freight location codes enter the relevant code for.

How to pay tariff is related to shipping methods. The tax is imposed based on the Entry 52 of the State List from the Schedule VII of the Constitution of India which reads. Exemption to specified goods falling under various Chapters Notificatrion No10107-Cus dt1192007.

Goods and Services Tax. The Finance Act 2022 had inserted a new section 194R to the Income Tax Act 1961 providing for deduction of tax at source TDS 10 on the benefit or perquisite paid to a resident businessman or professional arising from its business or profession and the provision of this section is applicable from 1st July 2022.

Shipping To And From Canada Yrc Freight Ltl Since 1924

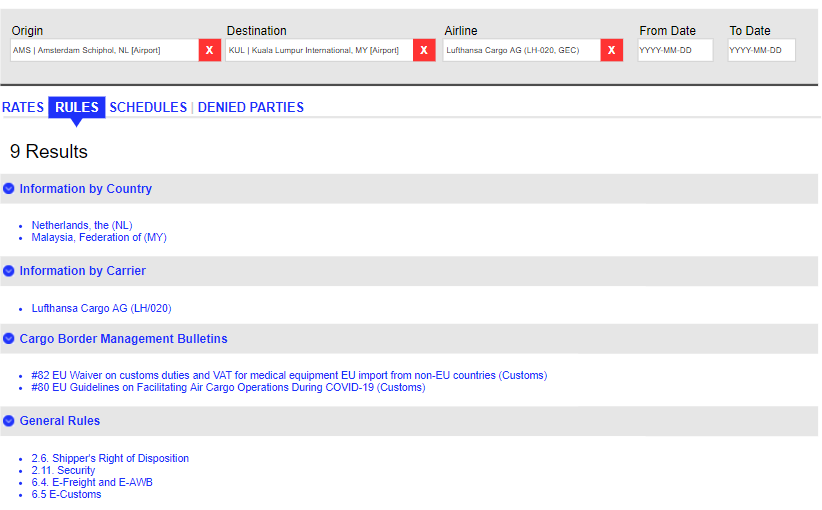

Iata Air Cargo Tariffs And Rules What You Need To Know

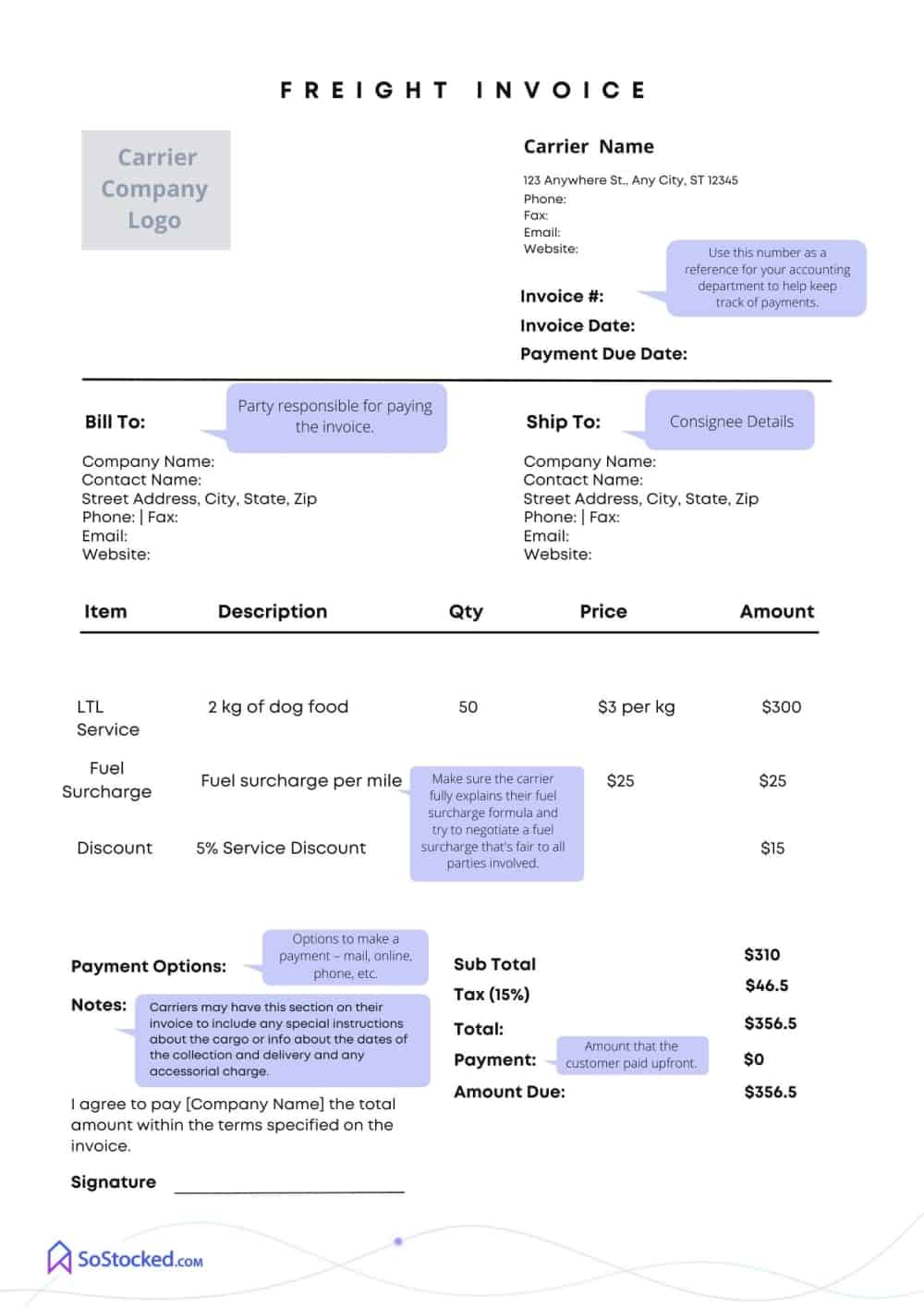

How To Read And Understand Your International Airfreight Bill

Freight Forwarder Fees Checklist Protect Your Profits

Ddp Air Cargo To Us Uk Europe Germany France And Amazon Warehouse With Logistics Service With China Freight Forwarder China Freight Forwarder Shipping Agent Made In China Com

Freight Forwarder Fees Checklist Protect Your Profits

Service Area Transit Time Tax Air

Extra Charges To Expect When Shipping Internationally

March Industry Update Geodis United States

How To Read And Understand Your International Airfreight Bill

How To Read And Understand Your International Airfreight Bill

Service Area Transit Time Tax Air

Freight Forwarder Fees Checklist Protect Your Profits

Freight Rate Calculator Shipping Costs Via Air Sea

Iata Air Cargo Tariffs And Rules What You Need To Know

How To Read And Understand Your International Airfreight Bill