how are property taxes calculated in pasco county florida

Please note that we can. This simple equation illustrates how to calculate your property taxes.

Penny For Pasco Pasco County Fl Official Website

Search all services we offer.

. As calculated a composite tax rate times the market value total will show the countys whole tax burden and include your share. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax. Pasco County collects on average 087 of a propertys.

These are deducted from the assessed value to give the propertys taxable. Please visit our records search page locate your property then click on the Estimate Taxes link at the top. Pay Your Taxes Online.

This is largely a budgetary exercise with entity managers first. It would not apply to school district taxes. Amendment 3 still fell short of the margin.

The median property tax in Pasco County Florida is 1363 per year for a home worth the median value of 157400. Pasco County provides taxpayers with a variety of tax exemptions that may lower propertys tax bill. JustMarket Value limited by the.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. See full results and maps from the 2022 Florida elections. SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes.

Please contact the Pasco County Property Appraisers office for further information 352-521-4333. TAX COLLECTOR PASCO COUNTY FLORIDA Thank you for allowing us to serve you Menu. Mike Wells Property Appraiser Pasco County Florida Pasco County by the Numbers Dade City East Pasco Government Center Telephone.

Calculate Taxes To calculate your taxes we first need to locate your property. 5 hours agoThat exemption would apply to the value of the property between 100000 and 150000. Okaloosa County The median property tax also known as real estate tax in Pasco County is 136300 per year based on a median home value of 15740000 and a median effective.

The basic formula is. Choose Your Legal Category. Where 400000 ballots in Maricopa County await counting.

Property taxes are determined by multiplying the propertys taxable value by the millage rate set each year by the taxing authorities. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account. If you have further questions regarding taxes please call our Tax Department at 352.

How Are Property Taxes On New Construction Homes Calculated

Property Taxes Citrus County Tax Collector

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Property Taxes Polk County Tax Collector

How Are Property Taxes Handled At A Closing In Florida

How To Calculate Property Taxes Real Estate Scorecard

What Is Florida County Tangible Personal Property Tax

Florida Property Tax Calculator Smartasset

Florida Property Tax Calculator Smartasset

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

Pasco Commissioners Keep Property Tax Rates The Same So Expect A Bigger Bill

Palm Beach County Fl Property Tax Search And Records Propertyshark

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

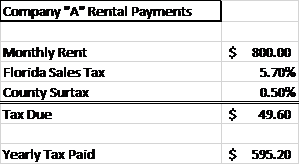

How To Calculate Fl Sales Tax On Rent

Home Pasco County Property Appraiser

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates